Private Cloud For Banks With CDWT

Ensure maximum uptime, security, and compliance by migrating, modernizing, and managing legacy bank IT environments on a private cloud.

From Traditions to Transformations: Private Cloud is Altering Banking Giants

Long ago, banking IT processes remained incomprehensibly complex, archaic, and resistant to change. The most significant aspect may be the bank’s strong alignment with billions of end customers, millions of enterprises, and their diverse financing requirements. As the stewards of day-to-day economic processes and the related enormous quantities of sensitive data, the solution to its IT and Ops transformation has never been simple, and as a result, its implementation has been limited.

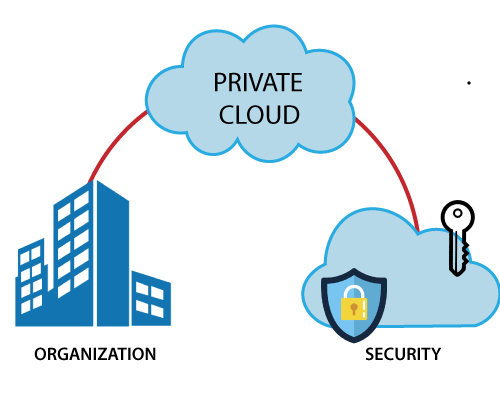

Before the digital era flourished and the epidemic accelerated it. BFSI enterprises quickly resorted to the cloud, although in its private guise, in response to intense competition and rising pressure to rapidly deploy contactless, always accessible, and anytime digital banking advancements. Private cloud, in contrast to public cloud, enabled banking organisations to have customised, end-to-end control over their cloud stack (fully dedicated infra, platforms, apps, databases, workloads) with near-100 percent availability, ultra-low latency performance, and military-grade security and compliance around-the-clock. Banks could utilise the cloud and maintain the same level of control over their ITOps without having to deal with cumbersome on-premises infrastructures.

Why Private Cloud Migration Is Such a Priority for Financial Institutions

Operational Needs

IT Needs

Competitive Needs

Security & Compliance Needs

Built for Maximum Availability, Performance, Security, and Returns: Introducing CDWT Private Cloud for Banks

CDWT, the biggest application-focused cloud managed services provider in the world and a cloud services partner for five of the world’s top twenty banks, provides a completely customised, high-performance private cloud solution for BFSI workloads. CDWT’s specialists begin by evaluating a client bank’s existing IT landscape and cloud maturity, then design a dedicated cloud architecture based on present and future requirements, and finally deploy the same fail-safe architecture across multiple landing zones (CAF-powered migration on high-fidelity local datacenters) to ensure the highest uptimes, ultra-low latency outputs, and maximum security and compliance. Additionally, CDWT assists financial institutions in modernising their mission-critical assets and managing the deployed private cloud end-to-end under a single SLA, from the infrastructure’s root to the application login layer.

CDWT Private Cloud for Banks: An Overview of Benefits

Up to 99.995% uptime supported by Tier-4, ISO-accredited, totally sustainable, regional datacenters.

Adopt containerization, microservices, and Kubernetes-powered platforms for efficient DevOps.

Cloud Adoption Factory (Migration Factory)-based migration of mission-critical assets and workloads to the cloud with minimal friction and zero data loss.

Pre-integrated Disaster Recovery with multi-zone hosting availability and rigorous RPO-TTO.

AIOps-powered Fully managed end-to-end operations from infrastructure to application login layer under a single SLA with up to a 50 percent cost savings

Management of databases is streamlined. Integrate comprehensive analytics for superior decision-making

Cloud architecture that is fully compatible with regional and worldwide banking regulations, including MAS, SAMA, RBI, and others.

Integrate private cloud with other important on-premises environments, public or hybrid cloud ecosystems, and endpoint environments

Multiple solutions, applications, and IT platforms without a cohesive architecture present challenges for business continuity and disaster recovery.

Governance and compliance management of independent IT systems and applications are fraught with obstacles.

PRIVATE CLOUD FOR BANKS

Beginning Your Private Cloud Journey with a Tailored Workshop: Simple Steps, Significant Impact

The CDWT Workshops are designed by industry experts to assist banking organisations in analysing their current cloud maturity, discovering and realising the true potential of cloud transformation, and charting an effective private cloud roadmap for maximum returns at minimum costs; security and compliance are also addressed.

WORKSHOP OBJECTIVES

- Experience CDWT Private Cloud possibilities for Banks

- Discover the best use cases for your banks with Infrastructure As-Is study reports and compliance and security gap analyses.

- Under Database Migration Plans with the three-pronged Migration Factory Approach for the highest level of data integrity and zero data loss

- Develop a roadmap with SLAs, milestones, and deliverables established for each stage

-

WORKSHOP SCOPE

- Service dependency-based Cloud Adoption Framework (CAF) Assessment for Banks

- App, Infrastructure, Data Modernization, and DevOps Impact Recommendations

- Assessment of existing security postures and AI-based suggestions for improvement

- AIOps and Automation-powered Managed Services Advisory suggestions

-

100+

Cloud platform migration and implementation for 100+ banks.

18

18 global complaints were associated with cloud-based security solutions.

30

Using ISVs to power the cloud for 30 Core Banking and Digital Banking applications.

~100

100 Aligned Processes and Governance Metrics for Banks

Strict high availability SLA requirements for production 99.99 and DR

The automation of managed services

Cyberdrills, disaster recovery exercises, and participation in central bank examinations.