Bank in a Box

The modern financial system includes both antiquated processes and procedures and those that can be executed with the click of a mouse. Some processes/tasks are often time-consuming and error-prone, while others are completely frictionless. Banks are under pressure to upgrade their core systems and adopt new technologies for real-time transaction processing and rapid product launches due to a rise in consumer demand for digital experiences and more competition from fintech and other digitally savvy enterprises. As a result, banks are embracing new technologies such as the cloud, a key facilitator of digital changes and a possible means of reducing technical debt.

Banks: the moment to upgrade the core cannot be postponed

- Offer seamless customer service

- Invest in the technologies of individual business units.

- Utilize the worth of all data, whether organised and unstructured.

- Develop IT flexibility while maximising the time and expenses associated with conventional IT maintenance tasks.

- Accelerate access to emerging technologies, including artificial intelligence, blockchain, and in-memory databases such as SAP HANA.

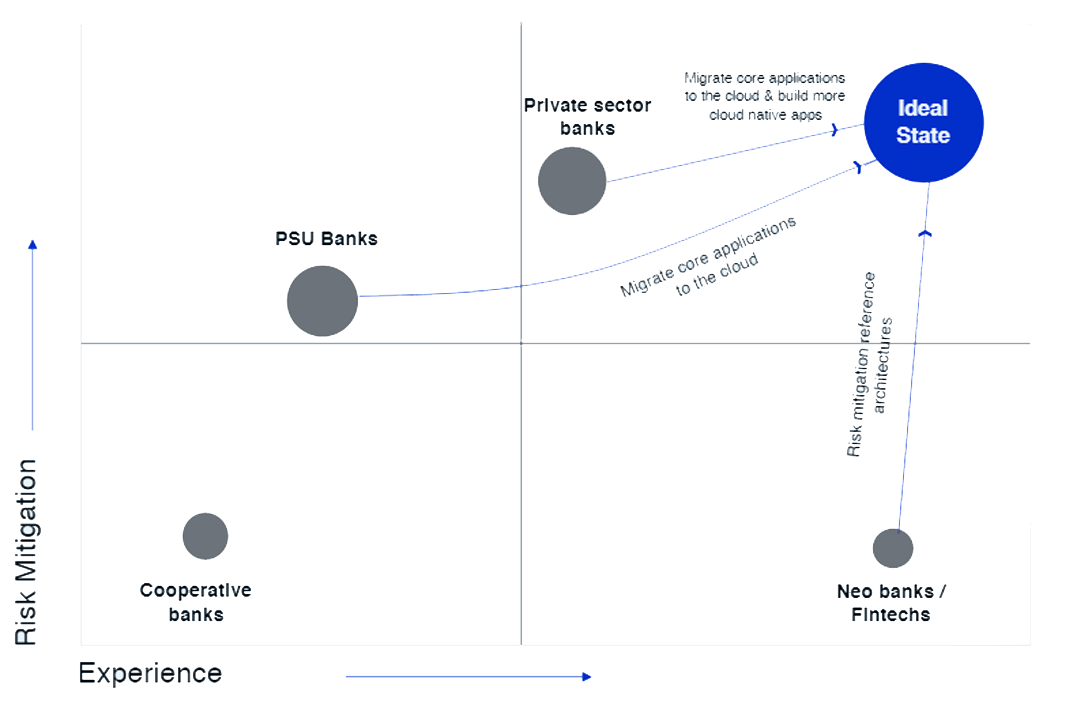

The Trade-Off

While digital transformation generates significant potential for businesses, it also adds a new dimension to the conventional risk perspective. In their pursuit of seamless consumer experiences, banks do not want to sacrifice compliance or security standards. However, they do not want to remain their old, inflexible selves in order to prevent transition danger.

Do you need to make this trade-off?

Whether you asked us if you should make this trade off, we would answer NO. Risk Mitigation and Customer Experience are of equal importance.

There must be a risk-free acceleration to the cloud.

The issue is not whether or which applications should be moved to the cloud, but rather how to safely migrate them.

For the majority of banks, migrating to the cloud has presented formidable obstacles.

hardly anything to do with the creation of new cloud-native apps

The cloud has everything to do with guaranteeing the perceived robustness of risk mitigation in their existing context.

Banks that avoid or proactively address transformation hazards will have a greater chance of completing a successful digital transformation without schedule or budgetary overruns. In addition, banks that periodically assess their methods in the areas of people, process, and technology with the assistance of a capable partner might find improvement opportunities for future large-scale reforms.

Experience vs Risk It is not a game of zero-sum.

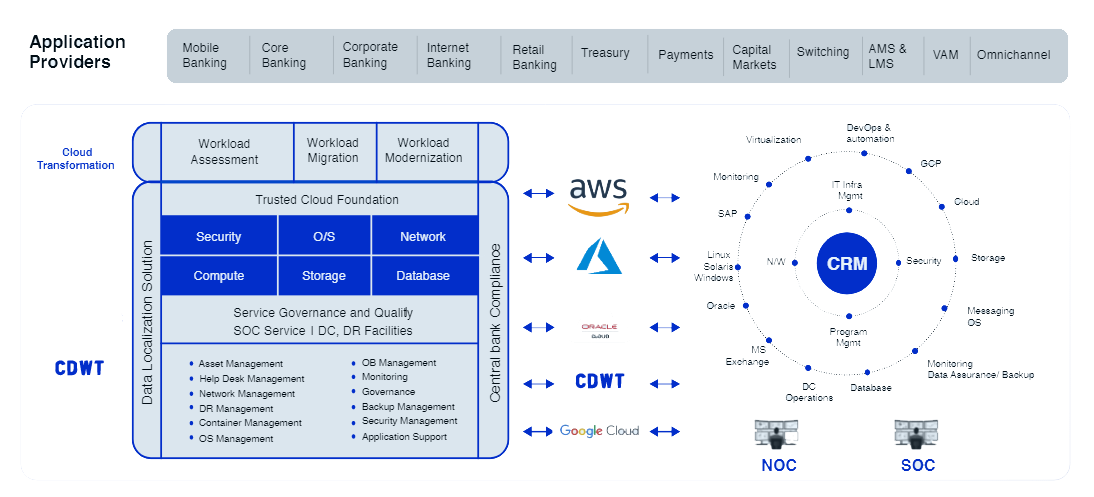

The Solution: CDWT Bank-in-a-Box

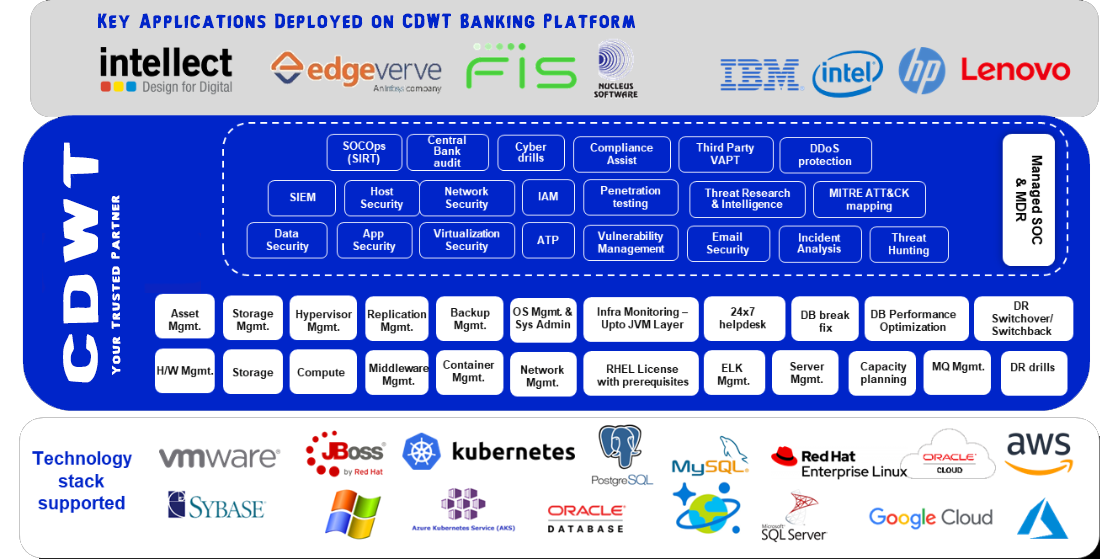

Bank-in-a-Box was developed by CDWT in collaboration with top core banking and digital banking application providers in order to offer a single point of responsibility with SLA upon application login. The cloud architecture is designed to meet the stringent requirements of risk-mitigated transformation security, compliance, availability, and flexibility, allowing banks to put their products on the market more quickly and expediting their digital transformation journeys.

Whether you are hosting a greenfield or brownfield core banking, LMS, or treasury configuration, or introducing new digital banking channels, CDWT’s Bank-in-a-Box facilitates a smooth transition to the cloud. As the banking sector advances toward digital transformation and adoption of new technologies such as Artificial Intelligence & IoT, and Blockchain, Bank-in-a-box provides a comprehensive IT solution.

Bank-in-a-Box – Framework for Integrated Managed Services for Banks

More than 40 Managed Services and Managed Security Services are made available through the Bank-in-a-Box platform.

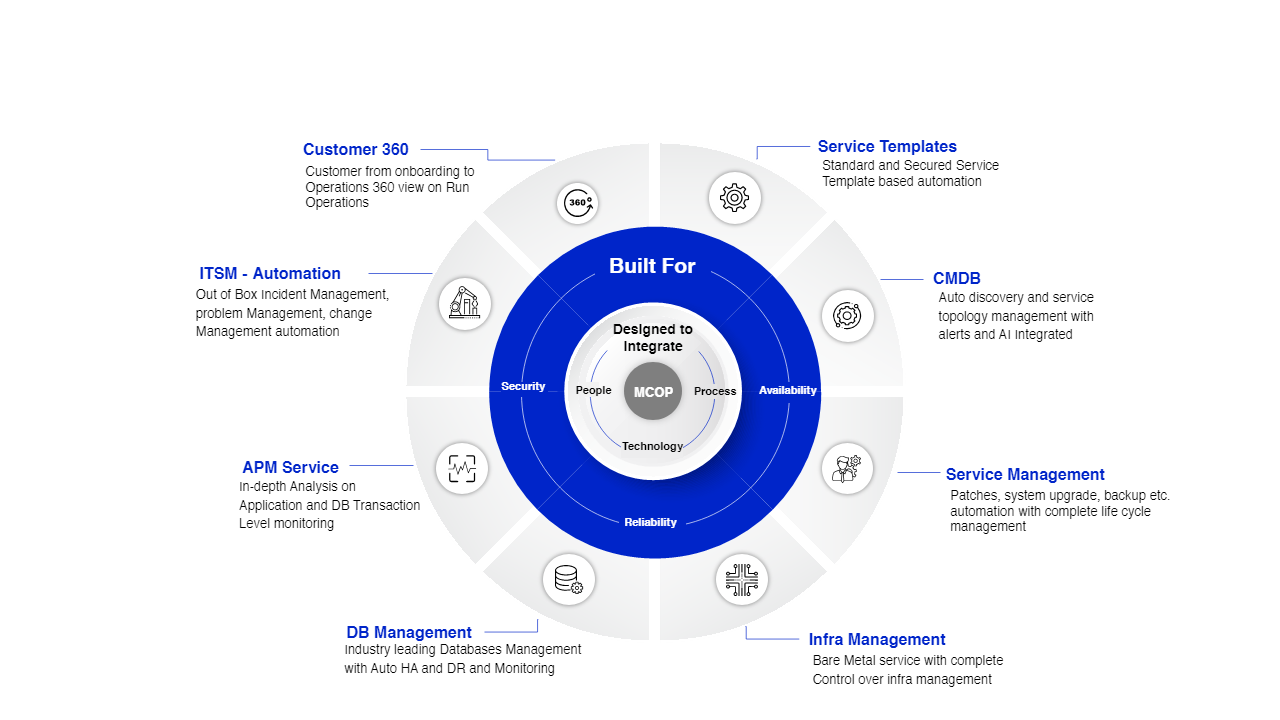

Make your IT operations resilient to disruptions and transformation risks.

The Mission Critical Operations Center is powered by our Self Healing Operations Platform (SHOP). It is a single source of truth for all IT and cloud-based operations (Self and third-party platforms), solutions-apps, and data, reinforced with proactive and preventative security management; effortlessly adaptable to any industry, any user’s IT environment, regardless of complexity.

This enables us to guarantee and provide managed services with a Single SLA supported by 99.98% uptime till the application login layer.

Bank-in-a-Box has a Mission Critical Operations centre backed by 25 Centers of Excellence that methodically manage all IT Operations and Banking Transformation requirements.

Why Bank-in-a-Box from CDWT?

As each firm is unique, its digital transformation path will be distinct. It is essential to comprehend our present skills and then map them to our intended objectives in the most effective manner. CDWT not only reduces time-to-market, but also enables institutions to maintain full control despite dynamic changes in regulatory, commercial, and consumer needs.

Here are the reasons you should choose Bank-in-a-Box:

Regulatory certified security stack with more than 40 Security measures particularly designed for banks

Total responsibility - SLA provided at application login

Compliance with local data residence and sovereign rules in 52 places worldwide

End-to-end ownership of the cloud journey, encompassing IT transformation and migration

Flexible price model per branch, per transaction, per account, etc.

Global Compliances Bank-in-a-Box adheres to

Industry Specific

Country Specific

Worldwide Standards

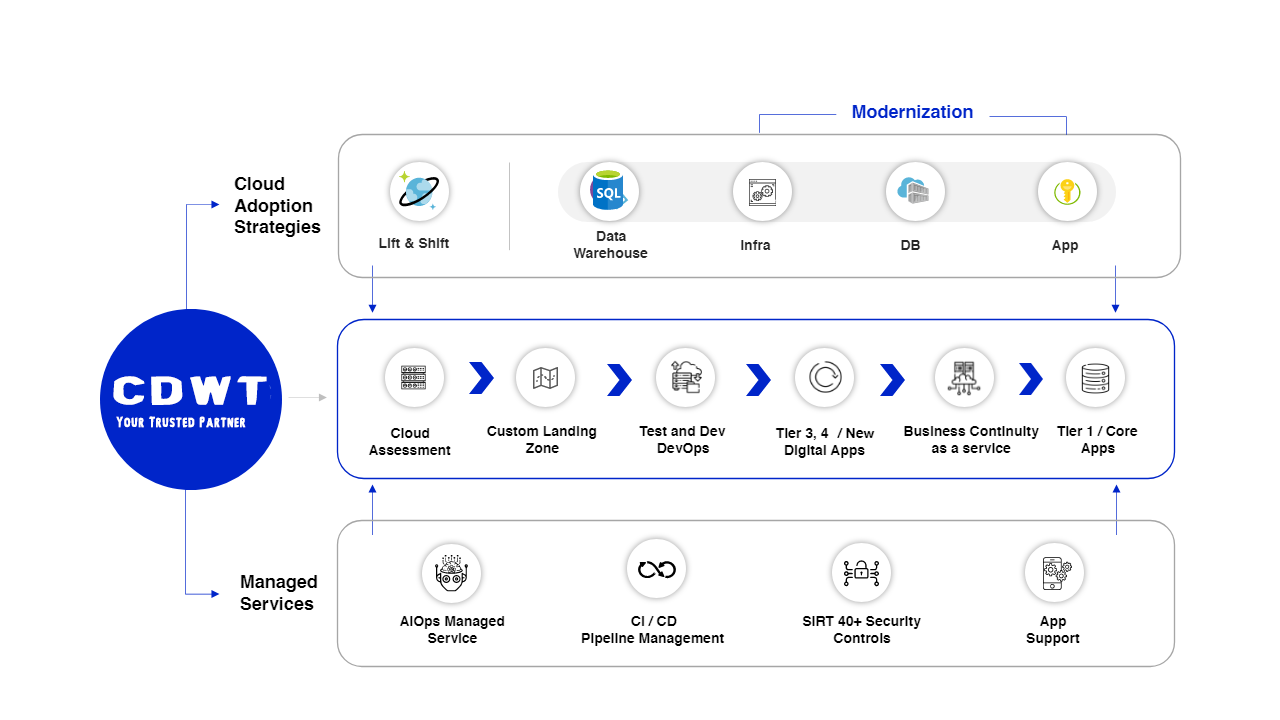

A Comprehensive and Adaptable Cloud Transformation Strategy

CDWT has vast expertise building and providing customised, all-encompassing banking solutions in a variety of regions and markets. Our proven cloud adoption approach for banks, based on ground realities, will provide you with an accurate knowledge of where you are and how your business may best accomplish its digital transformation objectives.

Our completely customised workshop caters to your specific requirements.

| Workshop Scope | Workshop Objective |

|---|---|

| Service dependency-based Assessment based on our Cloud Adoption framework (CAF) for banks | Experience CDWT Private Cloud for banks Understanding your current capabilities and map them to your desired goals. |

| Recommendations on Modernization initiatives with impact quantified: App modernization Infra modernization Data Modernization DevOps- CI/CD pipelinea | Discover the best use cases for your bank Infrastructure as-is analysis report, security, compliance. business continuity and business process gap analysis and mitigation plan. |

| Assessment of as-is security postures and actionable recommendations: Artificial Intelligence based Security Operations (AlSecOps) DevSecOps | Understand database migration plans How three-pronged migration approach works, while ensuring data integrity. |

| Managed Services Advice AlOps and Automation | Plan next steps Create a roadmap with milestones, SLAs, and deliverables defined at each step |