Health Insurance

The cost of health care in the United States may be rather high. Depending on the kind of treatment delivered, a single doctor’s office visit may cost several hundred dollars while an average three-day hospital stay might cost tens of thousands of dollars (or even more).

Health insurance provides a means to lower these expenses to more realistic levels.

A client pays an upfront fee to a health insurance firm, and this payment enables the consumer to get medical services according to the insurance plan for which they have signed up.

There are several kinds of health insurance plans and numerous care standards and arrangements in the United States.

- Funding for Public Insurance programs is provided by the government, which collects revenue via taxes.

- When a client becomes ill, Private Insurers utilize the premiums they receive from people and their employers to settle claims.

Types of Insurance

Health Insurance

Health insurance is a form of insurance coverage that reimburses the insured for medical, surgical, and occasionally dental expenditures. The insured may be reimbursed for expenditures incurred due to sickness or accident, or the care provider can be paid directly.

Worker Compensation

Workers' Compensation is a system of compensation for work-related injuries or death, funded by employer payments to compensation insurance. Each state's Workers' Compensation system is established by law.

No Fault/Auto Insurance

No-fault insurance is a form of coverage whereby all parties involved in an automobile accident are paid for losses, such as medical expenses and lost earnings, regardless of who caused the accident.

Health Insurance

- Health insurance protects individuals against unexpectedly high expenditures. Estimates place the average cost of a three-day hospital stay at $30,000, while the cost of treating a fractured leg might reach $7,500.

- Health insurance provides individuals with a vital financial safety net in the event of a medical emergency.

- The insured may be reimbursed for expenditures incurred due to sickness or accident, or the care provider can be paid directly.

- Both the government and private enterprises may provide health insurance. Consequently, there exist both governmental and private insurance schemes, such as,

Public Insurance

Medicare

- Medicare is a federal program that provides health care coverage (health insurance) to those who are 65 or older, under 65 and receiving Social Security Disability Insurance (SSDI) for a certain period of time, or under 65 and suffering from End-Stage Renal Disease (ESRD)

- Medicare is administered by the government Centers for Medicare & Medicaid Services (CMS).

- The program is supported in part by Social Security and Medicare income taxes paid by citizens, in part by Medicare premiums paid by Medicare recipients, and in part by the government budget.

-

Medicaid

- Medicaid is a public insurance program that offers health care to low-income families and individuals, such as children, parents, pregnant women, elders, and those with disabilities.

- It was established in 1965 and is jointly supported by the federal and provincial governments.

- Each state administers its own Medicaid programme in accordance with federal regulations.

-

Tricare

- Tricare is a health insurance programme administered by the federal government for military troops, their families, retirees, and survivors. It is provided to:

- Members of the military and their families

- Members of the Guard and Reserve and their families

- War Survivors

- Awardees of the Medal of Honor and their families

-

Private/Commercial Health Insurance Payers

Blue Cross Blue Shield Association

Cigna

Aetna

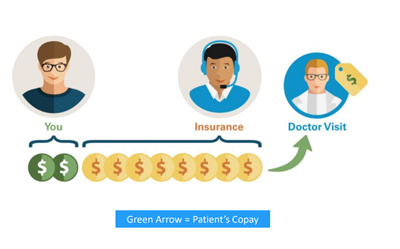

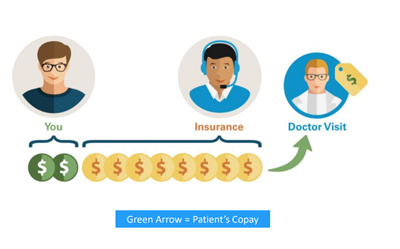

Cost Sharing in Medical Insurance

Copay

It is a tiny fraction of the entire cost and consists of a fixed fee paid by patients at the time of their doctor’s appointment. Copayments vary by coverage and may be altered if a patient visits a specialist instead of their primary care physician or seeks care outside of their provider network.

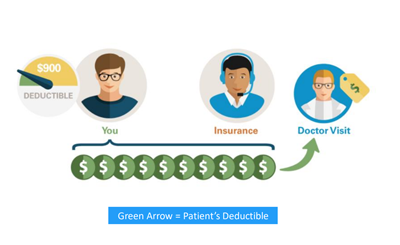

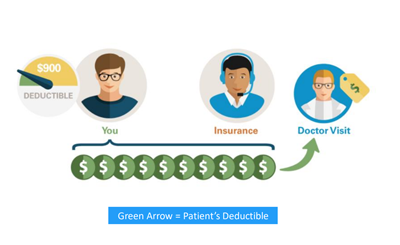

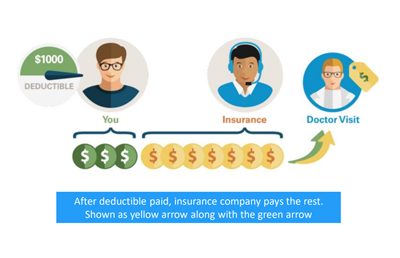

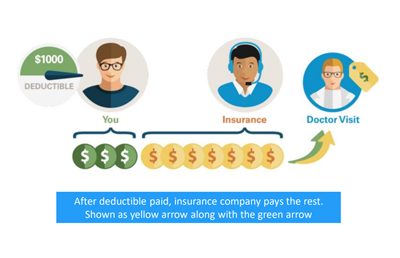

Deductible

It is the amount of a patient’s medical expenses that they must pay before their health insurance kicks in. This amount might vary amongst plans.

Coinsurance

Coinsurance is the method through which the patient and health insurer divide the expenses of treatment once the patient has met their deductible.

Out of Pocket Maximum

Types of Insurance Plans

Health Maintenance Oragnizations

HMOs- A health maintenance organisation provides all health services through a network of healthcare practitioners and facilities. Patients with an HMO may have:

- Fewest opportunities to pick their health care providers.

- The plan with the least amount of paperwork compared to others.

- A primary care physician who will oversee their treatment and recommend them to specialists as necessary, so that their care is covered by their health plan.

- Before seeing a specialist, the majority of HMOs will need a reference.

-

Preferred Provider Organizations

PPOs- Patients with a PPO may have:

- A modest level of flexibility to pick their health care providers - more than an HMO; they do not need a referral to visit a specialist from their primary care physician.

- Patients incur more out-of-pocket expenses if they see out-of-network physicians as opposed to in-network ones.

- More paperwork than with other plans if out-of-network providers are used.

-

Point-of-service

POS- POS plans combine HMO and PPO plan characteristics.

- A POS health plan provides more flexibility than an HMO.

- However, with a POS plan, you have the option to use non-network physicians, hospitals, and other providers.

- Using an out-of-network provider will incur additional fees.

-

Exclusive Provider Organization

EPO- EPO is an abbreviation for "Exclusive Provider Organization"

- As a member of an EPO, you have access to the physicians and hospitals inside the EPO network, but you cannot seek treatment elsewhere. There are no advantages outside of the network.

- In an EPO plan, referrals are not required to consult a specialist. You want much reduced negotiated expenses with an EPO plan compared to an HMO or PPO plan.

-

Comparison Between Insurance Plans

HMO vs PPO